In the short term, on the whole, the impact of the epidemic on the demand side of the non-ferrous metal industry exceeds that on the supply side, and the marginal pattern of supply and demand is loose.

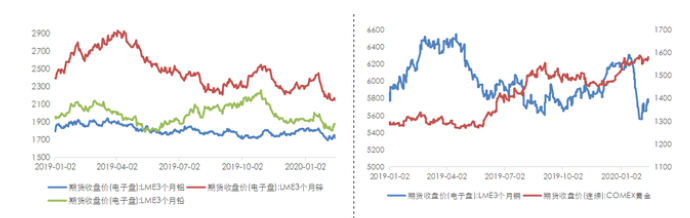

Under the benchmark situation, except for gold, the prices of major non-ferrous metals will decline significantly in the short term; Under pessimistic expectations, gold prices rose significantly driven by risk aversion, and the prices of other major non-ferrous metals fell even more. The supply and demand pattern of the copper industry is tight. The short-term decline in demand will lead to a significant decline in copper prices, and the prices of aluminum and zinc will also decline significantly. Affected by the shutdown of recycled lead plants during the Spring Festival and after the festival, the decline in lead prices caused by the epidemic is relatively small. Affected by risk aversion, gold prices will show a slight upward trend. In terms of profit, under the benchmark situation, it is expected that non-ferrous metal mining and processing enterprises will be greatly affected, and the short-term profit will decline significantly; The operation of smelting enterprises is basically stable, and the decline in profits is expected to be less than that of mining and processing enterprises. Under the pessimistic expectation, smelting enterprises may reduce production due to the restriction of raw material supply, the price of non-ferrous metals will continue to decline, and the overall profit of the industry will decline significantly; Gold enterprises benefited from the rise in gold prices and their profits were limited.

Post time: Mar-18-2022